Empowering SMEs for Global Growth

Easy and collateral-free trade finance solutions to fund your business growth

Unlock funds with tailored working capital solutions to drive global trade

Trade Credit Insurance

Lorem ipsum dolor sit amet, lorem consectetur adipiscing elit vel. Nullam semper ultrices scelerisque.

Learn MoreDomestic Credit Insurance

Lorem ipsum dolor sit amet, lorem consectetur adipiscing elit vel. Nullam semper ultrices scelerisque.

Learn MoreExport Trade Credit Insurance

Lorem ipsum dolor sit amet, lorem consectetur adipiscing elit vel. Nullam semper ultrices scelerisque.

Learn MorePolitical Risk Insurance

Lorem ipsum dolor sit amet, lorem consectetur adipiscing elit vel. Nullam semper ultrices scelerisque.

Learn MorePUT Options

Lorem ipsum dolor sit amet, lorem consectetur adipiscing elit vel. Nullam semper ultrices scelerisque.

Learn MoreFactoring

Lorem ipsum dolor sit amet, lorem consectetur adipiscing elit vel. Nullam semper ultrices scelerisque.

Learn MoreUnlock funds with tailored working capital solutions to drive global trade

Trade Credit Insurance

It protects sellers of goods and services on credit against the risk of customer non-payment due to customer insolvency, protracted default, political events, or acts of war that prevent contract performance.

Learn MoreInvoice Financing

Don’t let the unavailability of funds limit your growth. Convert your receivables into cash within 48 hours.

Learn MorePUT Options

Put Options offer an alternative route of taking a bearish position on a security or index. When a trader buys a Put Option they are buying the right to sell the underlying asset at a price stated in the option. There is no obligation for the trader to purchase the stock, commodity, or other assets the Put secures.

Learn MoreCollection Services

With decades of experience, VoloFin USA commercial (B2B) collection partners assist thousands of businesses across North America. Through long-standing partnerships, VoloFin USA can help collect in-country wherever your debtor is located.

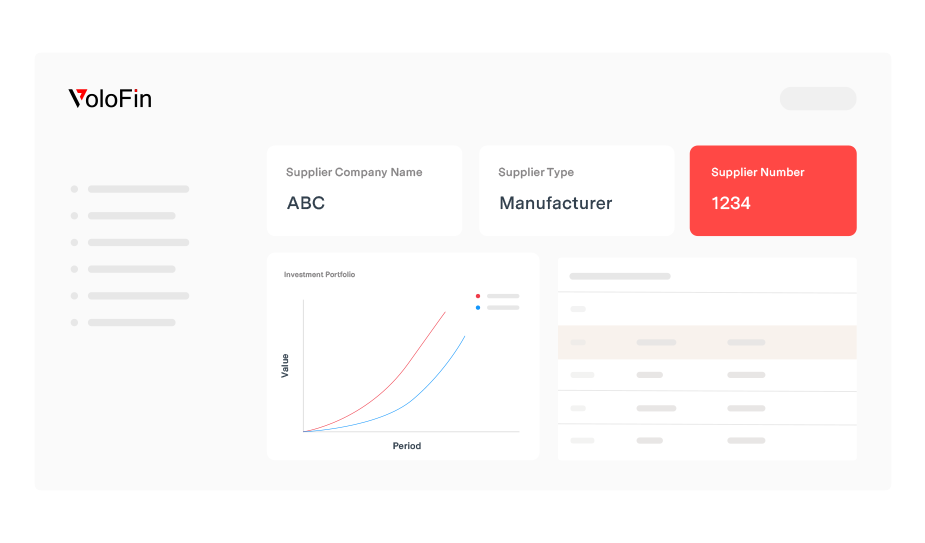

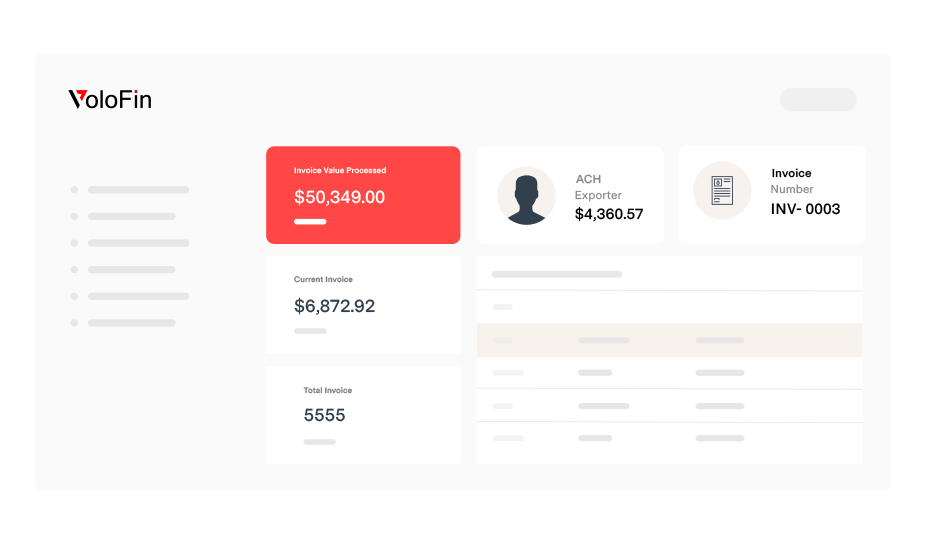

Learn MoreTrade finance solutions delivered via our state of the art blockchain digital platform

VoloFin’s user-friendly top of line portal allows enables users to access and manage the best financing solutions.

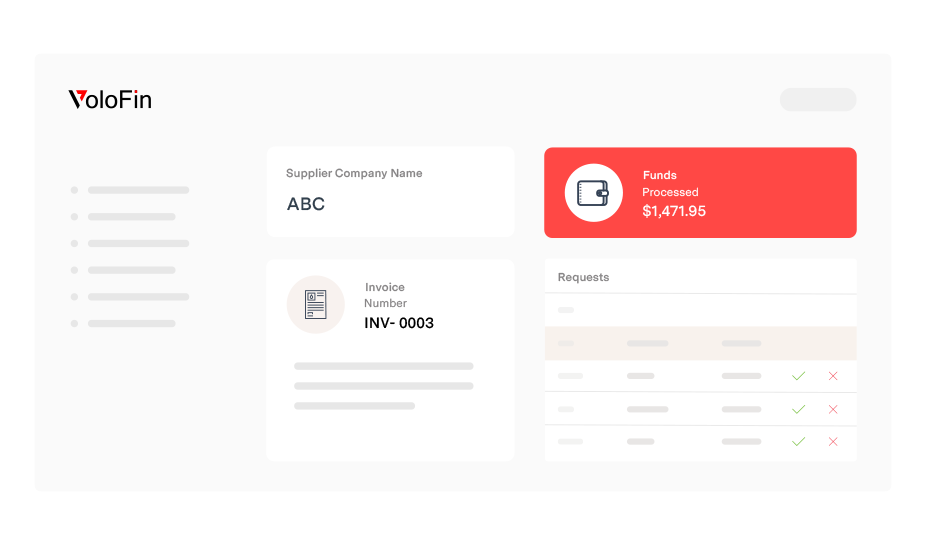

Our supplier portal will equip you to raise funding requests against any invoice of your choice – in just a few clicks.

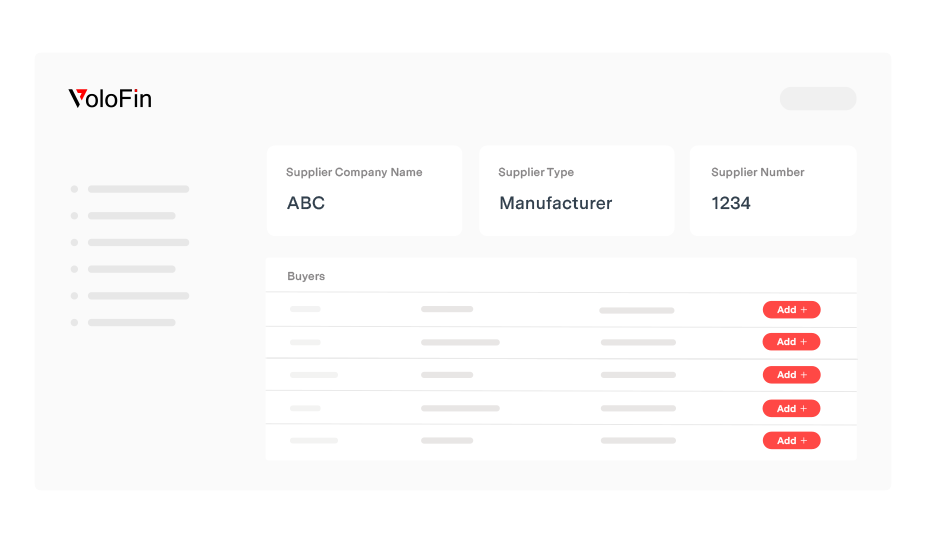

As a business, you can add your suppliers and buyers for quick and easy approval.

With the help of our agile system, you get full visibility into every transaction in your supply chain.

Accelerate your business with VoloFin

Why do thousands of SMEs trust VoloFin for their trade finance needs?

Fully automated self-onboarding

Industry first blockchain platform

Collateral free financing

Buyer risk assumed by VoloFin

Real-time in principal approval

We offer a range of trade finance solutions to suit your unique needs

As an agro commodity exporter our business is very seasonal. Our current banking lines can be insufficient for growth during this period. VoloFin helped us mitigate the working capital gap.

Chillies Exporter From Guntur

We deal with multiple buyers from across the globe, VoloFin's intuitive portal made the task of adding buyers and sending new funding requests very easy and quick. We can now avail working capital with just a few clicks.

Garment Exporter From New Delhi

Gain access to collateral-free working capital solution in just 48 hours

Empowering businesses globally with our working capital solutions

Singapore, 17th March 2022 - VoloFin, a blockchain-powered fintech platform with operations in Singapore, USA, and India announces strategic partnership with US-based alternative asset management group, Highmore.

Frequently asked questions

Our team of experts is here to support you with the answers to all your queries. Find the answers to some common queries!

Receivables financing or Invoice Factoring is a revolutionary non-recourse* working capital solution oriented towards any business exporting overseas and working on elongated credit period (30 – 180 days) or if your bank limits are insufficient for the growth of your business.

VoloFin ensures a shorter working capital cycle for your business, meaning you get paid as soon as the goods are shipped and we also secure you against certain non-payment scenarios ensuring your time is spent doing what you do best and not worrying about problems commonly related to international trade like: Lack of liquidity, Non-payment or collections on due-dates.

VoloFin provides easy access to working capital solutions and can extend a facility to you in less than 48hours thanks to our automated risk assessment. Once your limit is established you can get your invoices paid in 4 simple steps:

- Customer submits invoice to VoloFin

- VoloFin advances upto 90% of the invoice value within 24 hours

- Buyer pays VoloFin on due-date

- VoloFin settles the margin with it’s customer

VoloFin is a platform, this allows us to extend lines of upto 5 Mil USD* by leveraging it’s investor network. This means we’re equipped to handle working capital requirements of all shapes and sizes.

Banks have historically represented the primary source of lending for most business. However, bank limits are often insufficient for the growth of your business. This manifests itself in the form of a 109Bil USD financing gap in the Small – Medium sized industry segment. What’s more, bank limits are intrinsically linked to traditional forms of security or collateral. As a growing business, you might not want to invest in collateral further. That’s where our product fits in. Our product can either allow you to augment your current banking lines or replace them entirely while safeguarding your interests through non-recourse financing.

Fast, flexible working capital solutions to

Empower your business growth

Accelerate cash flow. Free-up liquidity. Instant funding for SMEs

We started working with VoloFin in 2021, VoloFin helped us tackle our liquidity woes by funding our export receivables. This helped us expand even during the pandemic.

Engineering Goods Exporter From Chennai